SECTION 5

START THE EXPORT PROCESS

Businesses need to prepare the documents and meet key requirements to export. The following export process can be followed by any business, however, some products may need to meet additional requirements to be exported from Timor-Leste and to enter specific countries.

Step-by-Step Guide to Export

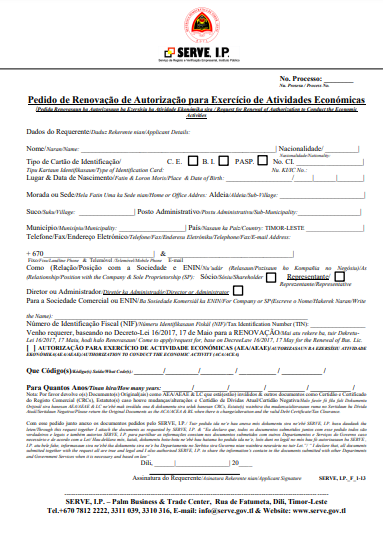

1. Register your business and obtain a commercial license from the Commercial Registration and Verification Service (SERVE)

- Fill the Application Form for Business Registration and Licensing (Serve F1-3)

- See here for the different requirements for different types of businesses.

- Required Documents: Certificate for Commercial Authorization, Company’s Statute, Tax Identification Number (TIN), Certificate of Risks

- Note: if you do not have a TIN Number, Tax Authority will issue it (See Step 2 to obtain a TIN number)

- Submit the hardcopies of the documents to SERVE

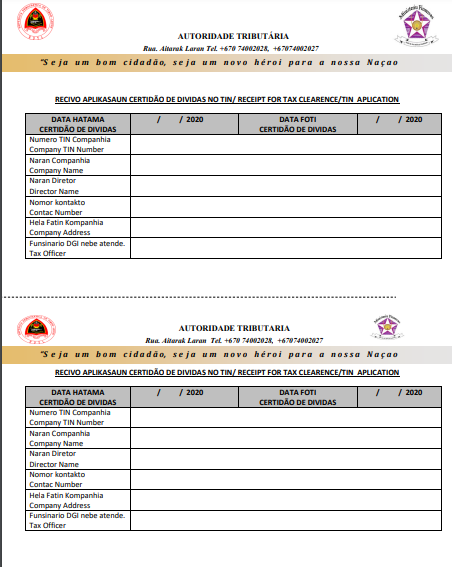

2. Obtain a TIN and Debt Certificate from the Tax Authority

- For the TIN, fill the TIN Application Form. Different types of businesses need to fill different forms, see here

- For the debt certificate, fill the Dividas form for the debt certificate

- Required documents for debt certificate: Association article, commercial license, location map, ID card of Director and Owner of the business, the total value of imports and exports.

- Scan the forms and documents and submit via email to info@attl.gov.tl

3. Obtain an Export License Permit from the National Directorate of Quarantine and Biosecurity

- Go to the National Directorate of Quarantine and Biosecurity office (See Contacts and Resources) to pick up the application forms for export license

- Required documents: business registration, commercial license, TIN, debt certificate

4. Obtain a Certificate of Origin from the Ministry of Tourism, Commerce and Industry (MTCI)

- Required documents: Bill of Booking Container (from shipping agency), invoice of products (quantity and costs), commercial license, packing list, customs declaration, debt certificate, TIN, letter of application to MTCI (include list of goods to be exported), ID Card of Director of the business

- Submit the hardcopies to the National Directorate of External Trade, MTCI

- The process normally takes 2 – 3 days

- After obtaining the Certificate of Origin, businesses need to bring it to Customs to sign it

Consider contacting a licensed

Customs Broker to prepare for the Customs Declaration.

Customs Broker to prepare for the Customs Declaration.

5. Submit a Customs Declaration to the Customs Authority

Step 1: Preparation

- Prepare the necessary documents

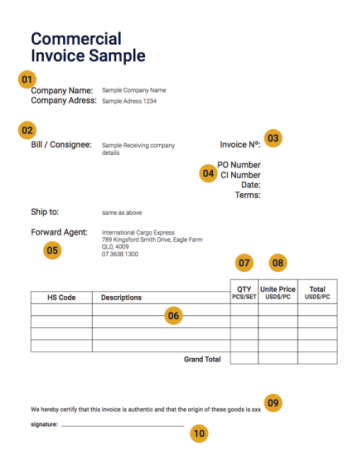

- Required documents: Packing List and commercial invoice (See here for example), required permits and licenses (export license or certificate of origin)

- Make a Customs Declaration (Declaracao Aduaneira Unica (DAU)) and submit to the ASYCUDA World system. (See here for example of DAU)

- Note: Export declarations must be submitted at least 1-working day before the arrival of the exporting vessel

- Fee: USD $1

- DAU will be assessed and routed within ASYCUDA World. Goods may be routed to orange, yellow or green lane depending on their risk.

- Orange lane: Goods will be x-rayed using the cargo scanners and DAU will be reviewed for any inconsistencies/error.

- Yellow lane: DAU and supporting documents will be reviewed for any inconsistencies/errors. Goods may be routed to orange lane for X-ray by Cargo Scanner and physical examination.

- Green lane: Goods will not need to complete any checks at point of Export. On rare occasions, goods may still need to be inspected.

- Exporters make the necessary amendments, if any. Then, customs will amend the declaration.

- Once checks are satisfactorily completed, Customs will update the declaration within ASYCUDA World and issue the exporters/customs broker with an Assessment Notice.

- Exporters must make the necessary payments within 10-working days of the Assessment Notice being issued otherwise a surcharge will be applied. You can make payment in the following ways:

- Banks: exporters can pay in cash at the Banco Nacional Ultramarino (BNU), or the Banco Nacional de Comercio Timor Leste (BNCTL)

- E-pay: In some locations, exporters can pay using a debit or credit card. Please check with the exporters’

- Once payment has been made, exporters’ or their customs broker should take a copy of the payment receipt to the customs cashier. Customs will then acquit the payment within the ASYCUDA World system.

- Following acquittal of the payment, the Export Release notice is generated for Customs within ASYCUDA World system when the Payment Receipt is issued.

- Customs will then check the seal number(s) on the exporters’ container(s) and add them to the Export Release page.

- Customs will validate the release within ASYCUDA World, and the goods will then be cleared for loading onto any export vessel. See Importing & Exporting Goods for the full export process.

Note: The container must be sealed upon arrival at the Port, otherwise the container will not be able to enter for processing and loading on to the vessel until seals are applied.